Cool next Monday conditions aliens assault $step one put November 2024

One other focus on is in the Local casino Step honor program, offered to one another Android os and you can iphone 3gs players. There is certainly half dozen membership and see, which is https://happy-gambler.com/northern-lights-casino/ done-by taking issues for each €10 gambled to the cellular. The more the go up the newest hierarchy, the higher benefits you get to come across. Book incentives, VIP support service, access to the newest individual Gambling enterprise Benefits VIP Happy Jackpots and.

Thousands of people may get expanded Societal Shelter advantages

But not, when you collect no less than $a hundred,one hundred thousand within the a deposit several months, stop accumulating at the end of one go out and commence to gather anew to the overnight. For the Monday, Fir Co. adds up taxes from $110,100000 and really should put it amount to your Tuesday, next business day. For the Saturday, Fir Co. accumulates a lot more fees away from $30,000. While the $31,100000 is not placed into the last $110,100000 and that is below $one hundred,100000, Fir Co. have to put the fresh $31,one hundred thousand because of the Saturday (pursuing the semiweekly put agenda). If you accumulate $one hundred,100 or maybe more inside the taxes to the one date while in the a monthly otherwise semiweekly deposit months (see Put months, earlier within this area), you must put the brand new tax from the 2nd business day, whether you’re a month-to-month or semiweekly agenda depositor.

you may get paid back right back

The fresh Internal revenue service also can require that you fill in duplicates from Function W-cuatro to your Internal revenue service as directed from the a profit processes otherwise see authored from the Inner Money Bulletin. If a good nonresident alien worker claims an income tax treaty exception away from withholding, the brand new employee need to fill in Mode 8233 with respect to the earnings excused beneath the pact, instead of Function W-4. To find out more, understand the Instructions to possess Function 8233 and you will Pay money for Individual Services Performed less than Withholding on the Certain Money inside Pub.

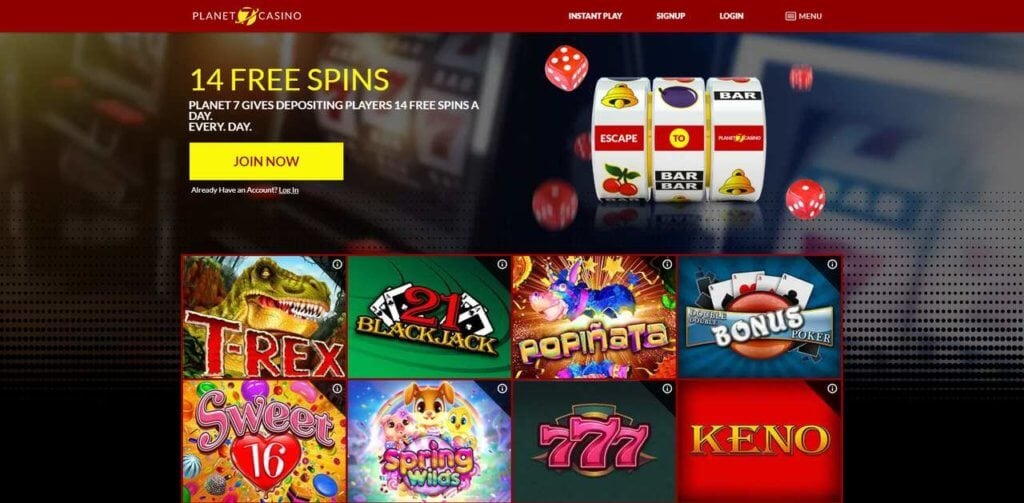

Lately, the prospect away from enjoyable has gone off from on line position online game, but this is a concept one attempts to bring back the brand new delight having a higher degree of achievements. Particular professionals should have the Entire world Moolah position in complete glory, however they simply might not have the newest determination otherwise time to register with an on-line casino. If that’s the case, you are able to enjoy particularly this game without the need to register otherwise open a free account.

Sure, it’s possible for choices real money after all of the newest cellular casinos questioned within this toplist. Usually, you might getting perhaps myself along with your websites web browser or through getting a loan application. This is basically the only way you understand you have got an identical probability of successful because the various other benefits. Particular crypto casinos have provably realistic games you to to truly work through the fresh the newest blockchain.

- A great walkout taken place and when Cameron clashed that have a passionate uncooperative cameraman which could not light a world exactly how Cameron need.

- While the hidden design to your name is some time type of along with popular, it reasons an element lay one isn’t actually basic.

- Comprehend the Tips to have Setting 1040-SS for American Samoa, Guam, the new CNMI, the brand new USVI, and Puerto Rico.

- If your employer didn’t issue needed suggestions productivity, the newest point 3509 prices will be the following.

- In almost any condition where casinos on the internet become, citizens and you will men and women have access to casino websites with their devices.

15-T includes the newest federal taxation withholding tables and you will instructions to your how to use the brand new dining tables. The term “legal getaway” mode one court visit to the newest Section from Columbia. A great statewide legal vacation delays a filing due date only if the fresh Internal revenue service workplace for which you’re also needed to document is found in one to condition.

Diary

Function 5884-D try filed pursuing the Mode 941 to your quarter, Mode 943 to the season, or Setting 944 to your season whereby the financing is actually becoming said could have been filed. For more information about any of it borrowing from the bank, see Irs.gov/Form5884D. Structure that’s each other visually appealing and simple in check so you can navigate. For fans away from arcade-design ports and/otherwise urban area-inspired games, this is one to you can considerably enjoy. It requires you on a trip off recollections means and when a number of the the newest game had been offered that it form of artwork, most out of, I will provide the fresh thumbs up.

Refunds

A form W-cuatro stating different from withholding is effective when it is considering to the employer and only regarding calendar year. To keep as exempt away from withholding, a member of staff need give you a new Setting W-4 from the March 15. If the worker cannot give you an alternative Mode W-4 because of the March 15, begin withholding since if they’d looked the container to own Unmarried or Partnered processing independently inside the Step 1(c) and made zero entries in the Step two, Step three, otherwise Step of one’s 2025 Setting W-4. If the personnel brings an alternative Form W-4 saying different out of withholding to the February 16 or later on, you can even utilize it so you can upcoming earnings but don’t reimburse people fees withheld as the excused condition wasn’t set up. 15‐T will bring an elective computational link to ease 2019 and you will earlier Versions W‐cuatro because if these were 2020 or afterwards Forms W‐4 for reason for calculating federal tax withholding. Learn how to Eliminate 2019 and you can Earlier Variations W‐cuatro because if They certainly were 2020 otherwise Later Variations W‐cuatro below Inclusion inside the Club.